Need Help with Taxes at the Last Minute? Quick Last-Minute Tax Filing Tips

No need to fret – before you start feeling stressed, we’re here to simplify the process and make it more manageable. Whether you’re flying solo or managing a small business, we’ll decode the technical terms, unravel the paperwork, and provide top-notch strategies to help you maximize your earnings and minimize your tax bill.

Tax returns are the government’s way of ensuring everyone pays their fair share. If you’re self-employed, freelancing, running a business, or earning income not automatically taxed, you’ll likely need to tackle one of these forms. Think of your self-assessment tax return as a report card for your finances, submitted annually to HMRC, outlining what you earned and spent.

But don’t worry, it might seem daunting, but with a little patience and some handy online tools, you can prepare for the end of the financial year and sidestep any tax surprises. So, take a deep breath, get comfortable, and let’s dive into the essentials of self-assessment tax returns, whether you’re filing tax return Salt Lake city.

The Best tips to remember for your tax return this year

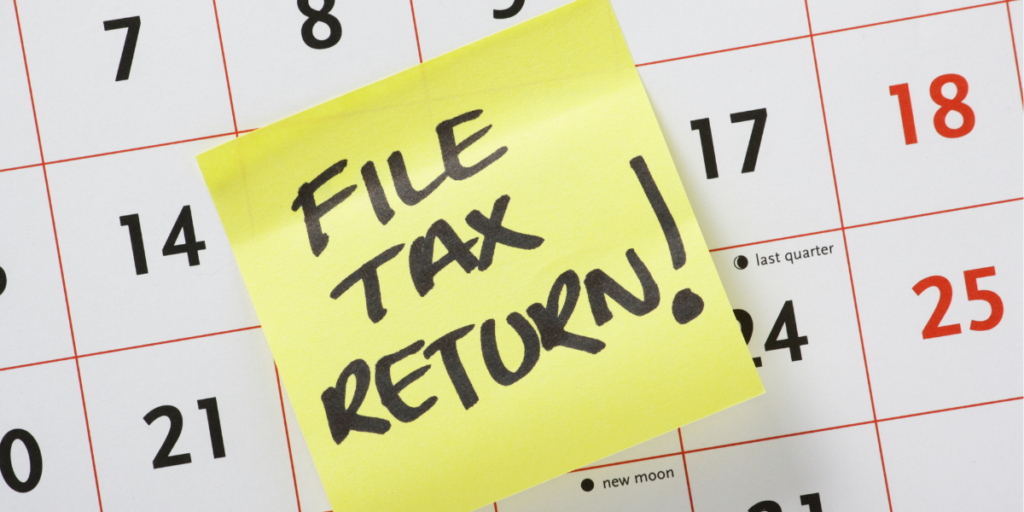

Self-assessment deadlines

Make sure to keep track of important dates for your Utah state tax return. On April 5th, gather all financial info for the UK tax year’s end. If you’re new to self-assessment or need to register, notify HMRC by October 5th. October 31st is the deadline for filing paper tax returns if you want HMRC to calculate your bill.

By January 31st, file your return and pay any owed tax. April 5th marks the new tax year’s start; make your second payment on account by then. July 31st is the deadline for any remaining tax owed. And remember, October 5th is crucial if you missed the July deadline. Keep these dates in mind to stay organized and meet your tax obligations smoothly throughout the year.

Gathering necessary documentation

Sure thing! Doing your tax return Salt Lake city can be tricky. It can be hard to know which papers and receipts you need. But don’t worry! We’ve made a checklist you can print out. It’ll help you stay organized while you get everything ready for your Utah state tax return. With this checklist, you won’t forget anything important. So, get your papers together, follow the checklist, and doing your taxes will be a breeze in Salt Lake City, Utah!

Common mistakes to avoid

-

- Procrastination is a common blunder when Utah state tax filing, leading to rushed errors or missing deadlines.

-

- Accurate income reporting is crucial; forgetting sources like self-employment income or taxable benefits can result in underreporting earnings.

-

- Math mistakes in tax liability calculations, deductions, or child benefits can cause overpaying for underpaying taxes.

-

- Forgetting to claim eligible deductions and allowances, such as earnings above the student loan repayment threshold, can lead to paying more tax than necessary.

-

- Not updating HMRC about personal or financial changes can result in incorrect tax calculations.

To avoid these mistakes, maintain accurate records, file returns on time, double-check calculations, and seek professional advice if needed. These tips apply to Utah state tax returns.

Tax deductions and allowances

In the UK, taxpayers have many ways to save on taxes. You can claim personal allowance, which is £12,570 for the 2022/23 tax year, to earn income tax-free. If you’re married or in a civil partnership, you can transfer unused allowance to your partner. Savings allowance lets you earn interest on savings without tax. Dividend allowance allows tax-free income from investments.

Self-employed? Deduct business expenses from your income. Business owners can claim capital allowances on assets. Tax credits like working tax credit and child tax credit support low-income families. R&D tax credits reduce corporation tax. Schemes like EIS and SEIS offer tax incentives to investors. Also, pension contributions provide tax relief based on your income tax rate. Efficient financial planning can ease your tax burden.

Filling out the tax return form

-

- Register online for self-assessment: Visit HMRC website to get your UTR and activation code.

-

- Gather financial records: Collect all documents needed for accurate reporting.

-

- Log in to HMRC online service: Use your UTR and activation code to start your tax return.

-

- Report income sources: Include employment, self-employment, rental income, etc.

-

- Deductions and allowances: List eligible expenses, donations, personal allowances, etc.

-

- Capital Gains Tax: Report profits from asset sales and apply any exemptions.

-

- Check tax calculation: Review the system’s calculation for accuracy.

-

- Tax credits and other details: Claim tax credits and provide requested information.

-

- Submit tax return: Review for errors and keep a copy of submission confirmation.

-

- Payment: Pay any owed tax by the deadline through the HMRC portal.

-

- Stay updated: Consult latest HMRC guidance and seek advice if needed.

Self-employed and small business tips

Self-employed individuals and small business owners face unique tax responsibilities. Here’s tailored advice to guide you through the tax process. Record-keeping is crucial. Use accounting software to track income and expenses, simplifying tax return preparation and deduction claims.

-

- Register for self-assessment with HMRC promptly.

-

- Know allowable business expenses to reduce tax liability, including office space and travel costs.

-

- Budget for advance tax payments to avoid surprises.

-

- Understand National Insurance Contributions (NICs) for pension entitlement.

-

- Separate personal and business finances for accurate reporting.

-

- Explore tax-efficient structures like limited companies with an accountant’s help.

-

- Consider hiring a tax advisor for expert guidance.

-

- Stay updated on tax law changes that affect your business.

-

- For VAT, know when to register based on sales thresholds.

-

- Prepare for Making Tax Digital (MTD) if turnover exceeds the VAT threshold.

Penalties and appeals

Oops! Late or incorrect submission for tax return Salt Lake city? Don’t worry! Follow these steps: First, grasp the penalty notice. Then, gather evidence to support your appeal. Contact HMRC for guidance. If needed, formally appeal. If unresolved, escalate. Consider a tax tribunal if necessary. Keep organized records to prevent penalties. Remember, mistakes happen, and HMRC is open to explanations. Stand up for your case and appeal if needed.

Closing Out

So there you have it, a complete guide to sorting out your tax matters. Whether you’re a seasoned business owner or new to filing taxes, we hope these tips have simplified the process. Remember, Utah tax filing is convenient and secure. Understanding Utah state tax return process and the deadline is essential. We’ve covered everything from gathering your financial documents to maximizing deductions. And when it comes to completing your tax return form, we’ve provided a step-by-step guide.